Insights: Your World is Changing

Trends

December 27, 2018Reading time: 3 minutes

The Evolution of Retail Channels and Packaging

The Evolution of Retail Channels and Packaging

Retail Fragmentation is Creating Opportunity

The way consumers shop has evolved and divided from the traditional grocery store of twenty years ago. There are now many convenient options in every community:

- Drug stores

- Supercenters

- Value / dollar stores

- Mass merchandise / warehouse / club stores

- Convenience stores

- Online

Each of these channels creates a new layer of complexity for CPGs – understanding consumer motive, supply chain efficiency, size of store shelves and aisles, size of backroom storage space – thus creating new challenges and opportunities when it comes to the packaging of your product.

Why the change?

There are three key economic and consumer behavioral changes which are changing shopping trips and therefore impacting retail channels.

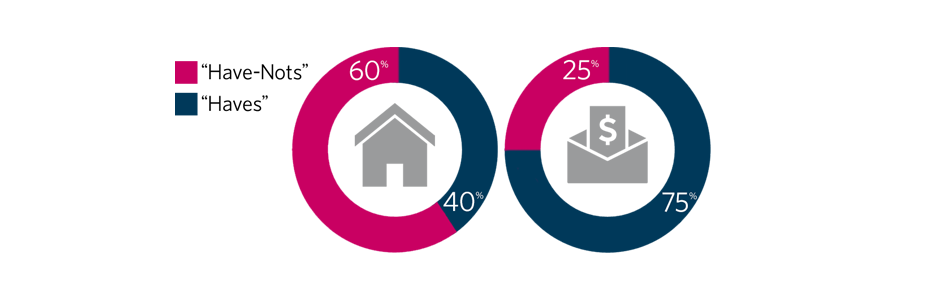

1. The “Haves” vs. “Have-Nots”

Consumer Incomes Are Shifting

The “Have-Nots,” defined as household incomes less than $60,000 per year, now make up 60% of households but only 25% of income. Their share of incomes sources is falling gradually, while the share of income sources continues to rise for the "Haves".1

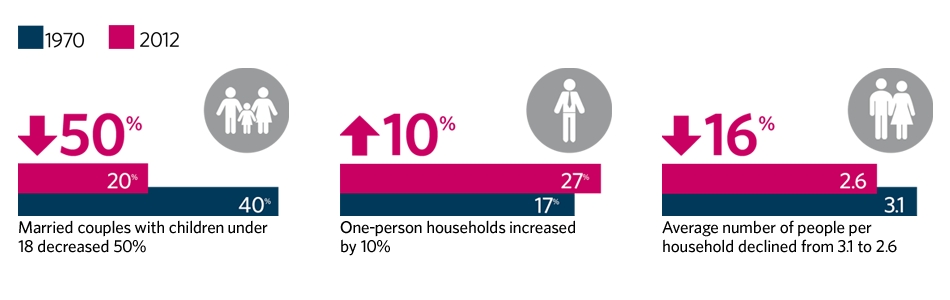

2. Households Are Shrinking

Compared to household sizes in 1970, significant changes can be seen.2

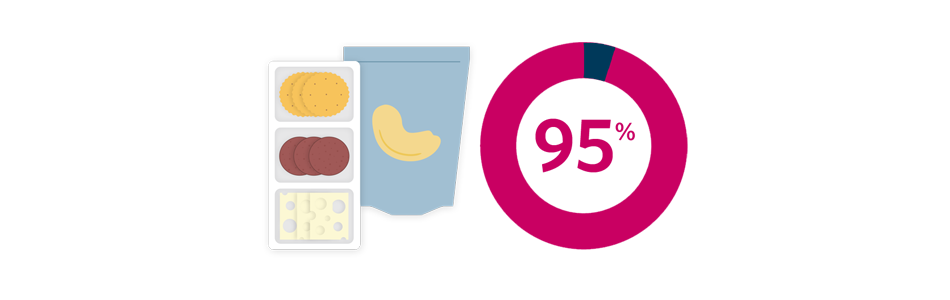

3. The Rise of Snacking

95% of adults in the U.S. snack at least once a day and 50% snack 2-3 times daily.3 This change in meal size and frequency has altered how stores and brands must package and promote their products.

Shopping Trips Evolve

As consumers' income, household size and eating behaviors change, naturally their shopping trips and habits change right along with them. As consumers select a store, it is based heavily on the shopping occasion.4

Implications for Packaging

As the popularity of various retail channels shifts to accommodate the shopping habits of today’s consumers, packaging professionals must tailor their package design to each one — sometimes with multiple versions of the same product.

Value Stores

There are more than 20,000 value stores in the United States and the number continues to grow. In fact, half of all new food stores are value stores. Value store shoppers typically have fewer dollars to spend than most.1

Packaging Considerations

- Smaller package sizes — Volume designed to hit a specific lower price point and consume less shelf space.

- Lower price points — Average consumer spend is just $11.00 per trip4; most successful CPG items are less than $5.00.

- Fewer package counts — Accommodates smaller backroom spaces, fewer staff and a supply chain structure where products are not being delivered on pallets.

- Visual impact — Shelves are shorter and aisles are more narrow making it crucial to stand out.

- Communicate value — Consumers in this channel want to feel like they are getting a good value for their dollar; communicating that on package is vital.

Club Stores

Club stores require membership fees for exclusive deals. Products need to have differentiation from market, quality and cost. Club shoppers typically have more available dollars than most.4

Packaging Considerations

- Six-sided billboards — Ensures your brand will always be visible when displayed on pallets or bulk boxes.

- Secondary packaging — Meets store requirements for high-volume / single purchase preference of club store shoppers.

- Pantry friendly — Optimized for simple pantry stacking once product is removed from secondary packaging or bulk boxes.

- Unique value — Club stores want to avoid direct price comparisons so they require differentiating SKUs in order to provide this value to their shoppers.

- Package colors — Lighting is usually dull in club stores; make sure colors on package react well in a dull environment.

C-Stores

Convenience stores account for 150,000 stores nationwide.4 They are dominated by purchase for immediate consumption. C-store shoppers typically spend just 2 minutes in the store and an average of $6.00 per trip.5

Packaging Considerations

- On-the-go consumption — One-handed to make the product easy to carry, open and consume, especially in the car. Requires minimal or no prep.

- Clear window — Allows shoppers to see the product freshness for themselves.

- Strong brand identification — Cuts through the cluttered environment of these smaller stores.

- Size and shape — Easily displayed on pegs or on smaller shelves.

- Stocking and reordering — Case counts make it easy for employees to order / stock (Example: If it takes six packages to fill a peg, cases contain six units per case).

E-Commerce / Online

The direct to consumer supply chain is much different than when products are shipped safely on pallets to retailers. Packaging must be strong enough to withstand the many touchpoints as a single product to avoid arriving damaged at consumers’ doorsteps.

Are you optimizing your packaging for different channels?

Clearly, packaging that is created for each channel’s needs has a better opportunity to deliver growth. But where do you start? To learn more about how you can optimize your packaging for the various retail channels, contact us.

Sources: 1. Kartar Retail; 2. US Census; 3. Mintel: Study on Snacking Trends, 2014; 4. Nielsen Consumer Panel; 5. External Research, Trip Analysis